One of the best ways to protect your assets is an irrevocable trust. It provides a number of benefits, including tax and gifting advantages, as well as protection against long-term care costs and other threats. At Sykes Elder Law, we can help you design a user-friendly trust that allows you to lock away assets for long-term protection, while still receiving income and enjoying the ability to decide who will receive those assets upon death.

The advantages of ours include:

Asset Protection

Immediate – Immediately upon establishing and funding the trust, you receive the benefit of protection from loss due to creditors, lawsuits, or scam artists that prey upon the elderly. While assets are in the trust, they are not subject to loss due to problems that the trust beneficiaries may experience: creditors, lawsuits, divorce, spendthrift habits, and so on. If a trust beneficiary has kids in college, the trust assets will not interfere with financial aid eligibility.

After 5 years – Our asset protection trusts have the most potential for those whose health and budget will allow them to leave the assets undisturbed for five years. At that time, assets in the trust are not countable for Medicaid purposes, and no transfer made to the trust is subject to Medicaid ineligibility penalty. You can qualify for Medicaid benefits for nursing home care, and the trust assets can remain undisturbed. Upon death, trust assets will not be lost to Medicaid’s estate recovery program.

Probate avoidance

Increasingly, many clients wish to avoid the expense and delay of the probate process when they die. A trust can allow assets to be distributed quickly to beneficiaries without going through the probate process or incurring probate fees.

Preserve tax advantages

Capital gains tax can take a significant bite out of assets that have appreciated in value, like a home or a stock portfolio. Upon death, most taxpayers enjoy a break from capital gains taxes on their home (known as the § 121 exclusion) or other appreciated assets (due to something called a “step-up in basis” for their heirs). With properly designed provisions, you can continue to enjoy these tax advantages for items placed into the trust.

Control superior to gifting

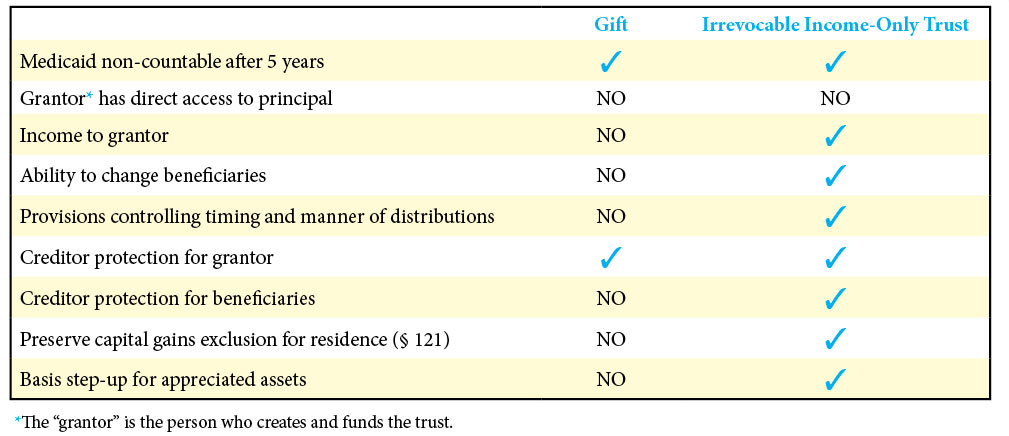

Some people try to protect assets by simply giving them away. A well designed trust offers a better solution – asset protection while maintaining a level of control superior to gifting. The following chart compares the two approaches:

Many people are amazed at how easy it is to have their funds and property in an asset protection trust. A great way to learn how a trust works, and how powerfully it preserves assets for you and your children, is to attend one of our entertaining and informative estate planning workshops. Contact us today to reserve a space. Click here for upcoming workshop dates and times.