(2009)One provision of the Deficit Reduction Act, signed by President Bush on February 8, 2006, increased the look-back period for Medicaid applications from three years to five years.

(The look-back period is the time during which the government will look to see if an applicant has given away assets, and if so, impose any applicable penalty.)

However, the expanded look-back period was phased in – it would take three years for this change to affect new applications. A directive from the Pennsylvania Department of Public Welfare explains why:

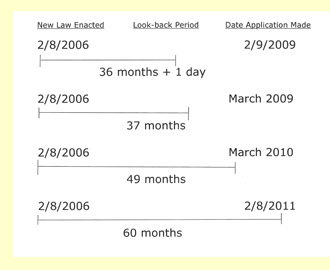

Any application made prior to February 8, 2009 which involves a transfer of assets occurring on or after February 8, 2006 would still be within 36 months of the date of the transfer. It is not until February 9, 2009 that applicants who transferred assets will be impacted by the lengthening of the look-back period. The look-back period increases on a daily basis from February 9, 2009 until the full 60-month look-back period is effective February 9, 2011. [Commonwealth of Pennsylvania Department of Public Welfare, Operations Memorandum – Medicaid OPS070205 2/26/07 at p. 2-3.]

The three years is now upon us.

The look-back period has begun to expand daily, and will continue to expand for the next two years, as illustrated above.